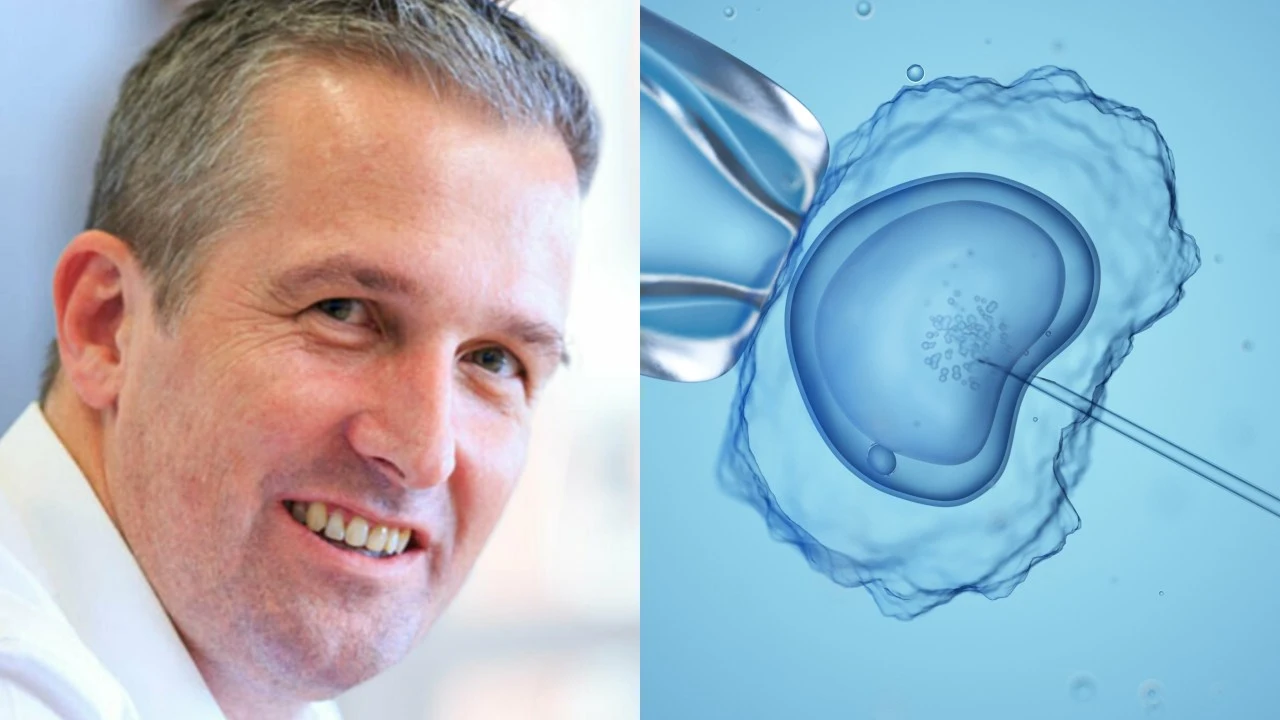

CEO of Monash IVF Michael Knapp has resigned two days after the fertility clinic mistakenly transferred the wrong embryo into a patient, the second incident for the company in months.

On June 5 the Clayton fertility clinic, in Melbourne’s south-east, admitted to wrongly giving a patient her biological embryo, instead of her partners as planned.

“Monash IVF has extended its sincere apologies to the affected couple, and we continue to support them,” the company said in a statement on the ASX on Tuesday.

The company said it was conducting an internal investigation into the incident, and comes months after it revealed that one of its patients had given birth to a stranger’s child in a shocking embryo mix-up that made headlines across the country in April.

In a statement to the ASX on Thursday, Monash IVF said it had accepted the resignation of current Chief Executive Officer and Managing Director Michael Knapp and that the board “acknowledges and respects his decision”.

“Since his appointment in 2019, Michael has led the organisation through a period of significant growth and transformation, and we thank him for his years of dedicated service,” the statement read.

Mr Knapp has occupied the role since 2019 after being appointed interim CEO in 2018 and was formerly Monash IVF Group’s chief financial officer and company secretary.

The company said its current Chief Financial Officer and Company Secretary, Malik Jainudeen, would be appointed as his replacement.

“Monash IVF Group Chief Financial Officer and Company Secretary, Malik Jainudeen has been appointed as Acting Chief Executive Officer,” the statement said.

Mr Knapp’s departure comes a day before the Australian health ministers meeting in Melbourne, with IVF regulation set to dominate discussion after the damaging mishap.

The Clayton incident caused major headaches for the embattled company, with its share price sinking by more than 27 per cent down to 54.4 cents on Tuesday morning after the shocking news was revealed.

The fall was the lowest the company’s shares had dropped since January 2020, with almost $70 million of shares lost on Tuesday alone.

The incident reported in April where a women gave birth to a stranger’s baby occurred at its Brisbane facility in 2023, with the company blaming “human error” for the reason behind the stuff up.

“Instead of finding the expected number of embryos, an additional embryo remained in storage for the birth parents,” a Monash IVF spokesperson said.

“(An) investigation confirmed that an embryo from a different patient had previously been incorrectly thawed and transferred to the birth parents, which resulted in the birth of a child.”

It was not until February, months after the mother had given birth that Monash discovered the blunder.

The string of incidents follow the company’s botched genetic testing program in 2019, which saw it pay $56 million in compensation to settle a class action involving 700 families.

The program was abandoned in 2020 when it was discovered that faulty test results may have seen sound embryos discarded.

Mr Knaap was also the managing the director of Monash IVF Group and had led the organisation since 2013.

The two stuff ups have eroded trust in the wider fertility industry, with numerous families who have had children through IVF speaking to the Herald Sun about the need for biological tests to be implemented to confirm the DNA of their children.