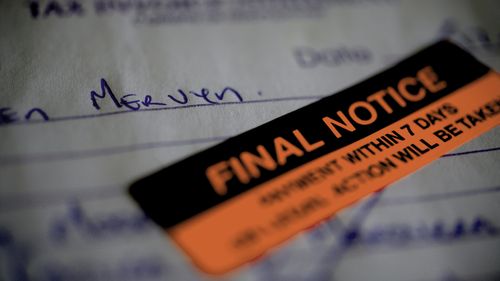

That’s according to a report by Financial Counselling Australia (FCA) released today, which found the number of people forced into bankruptcy is climbing, and the proportion of creditor petitions that end in bankruptcy has tripled over the last six years, up to 40 per cent.

It outlined that, while the measure should be used as a final step, many Australians have been declared bankrupt over debts as small as $10,000 – which can be largely composed of legal and interest fees.

“Forced bankruptcy is one of the most serious tools available to creditors and should only be used as a genuine last resort,” FCA chief executive Dr Domenique Meyrick said.

“Our report shows that without stronger safeguards and modernised laws, Australians risk losing their homes and livelihoods unnecessarily over relatively modest debts.”

While debt collectors and big banks have largely stopped pursuing bankruptcy over the past six years, other creditors are taking their place.

Strata bodies made up 12 per cent of all cases in 2024-25 – the same as non-bank business lenders and only marginally less than the Australian Tax Office at 13 per cent.

In 2020-21, they made up just 2 per cent of cases.

In one example, a woman who was unable to work due to the PTSD, anxiety and depression caused by a violent relationship was pursued by her strata for $10,400 – much of which was legal fees and interest – although she was able to borrow from friends and eventually avoided bankruptcy.

The FCA has called for strata bodies to be forced to provide hardship assistance and limit the legal action they take against residents in their buildings.

“Forced bankruptcy is appearing most in sectors that lack strong consumer protections, including rights to hardship support or fair dispute resolution,” Meyrick said.

“Put simply, it’s happening where safeguards are minimal.

“Practical reforms are urgently needed to ensure fairness and consistency in the system.”

The number of private schools pursuing bankruptcy has also escalated, up to 2 per cent of all cases last financial year – the same proportion as strata bodies in 2020-21.

Almost half of those matters were from five schools in Victoria: Sirius College, Oakleigh Grammar, Overnewton Anglican Community College, Trinity Grammar School in Kew, and Wesley College Melbourne.

As with stratas, FCA said hardship assistance should be enshrined in all sectors where the protections don’t currently apply.

It also made seven other recommendations for governments, including that the bankruptcy threshold to be raised from $10,000 to $20,000.

“These are practical, achievable reforms,” Meyrick said.

“They would make the system fairer and more consistent, helping to ensure bankruptcy is used only as a genuine last resort.”